Key to Wealth Real Estate Group – Berkshire Hathaway HomeServices

Register to get content like this sent straight to your inbox.

August 2021 Detailed Market Report

———–

Each Executive Summary Report is for a specific TRREB zone combination and includes a map of the included zones and a 4 page summary for each property type (detached, semi-detached, townhomes, condos)

The Information / statistics you can find in each Executive Summary Report include:

- Data comparing the – 1, 3, 5 and 10 year sales averages.

- Stats categories – Sales, New Listings, Active Listings, Average Price, Months of Inventory (MOI), Sales to New Listing Ratio (SNLR)

Stats Commentary

Similar to last month, rather than trying to cover all stats, we’ve focused on sales, new listings, and inventory. Why? Given the extremely low number of listings currently on the market, it may set the stage for a very interesting (and competitive) fall market when (or if) it finally gets started!

For a more comprehensive analysis including average prices, please refer to the 100+ TRREB reports section for direct access to detailed reports on over 38 different TRREB combinations, or click on the above section to view the accompanying slides & video.

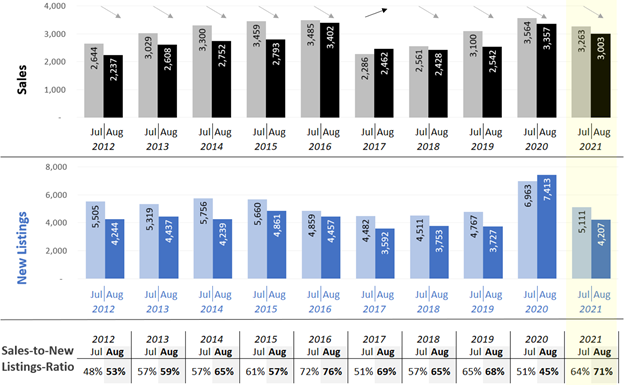

10 Year History of Sales and New Listings

While August 2021 sales were higher than the 5-year and 10-year August averages, we did see a reduction from August 2021 to August 2020. This was primarily driven by an abnormally busy summer in 2020 as the market continued to emerge from the COVID related pause during Q2/2020.

—

416 Sales / New Listing Details

There were 3,003 August sales across all property types within the “416” TRREB zones. Down -10% vs. August 2020, but up +9% vs. the 5-year August average and also up +9% vs. the 10-year August average.

While sales were down vs. July (which is typic given seasonality), the sales-to-new listings ratio (“SNLR”) tightened in the month rising from 64% in July to 71% in August signifying tightening market conditions (i.e., demand > supply).

The detached market SNLR climbed from 72% in July to 74% in August whereas the condo SNLR climbed from 59% in July to 69% in August.

“416” TRREB Zones – August vs. July – 10 yr History of Sales & New Listings

—

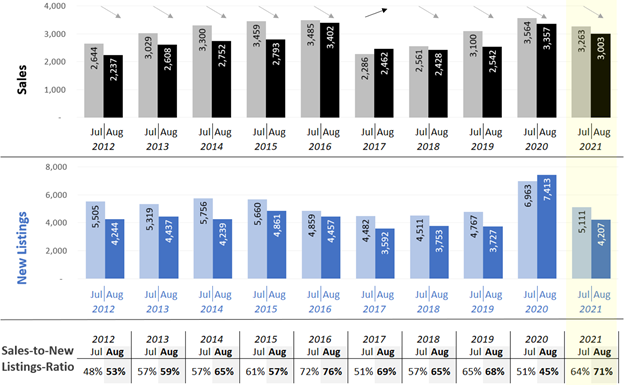

905 Sales / New Listing Details

- There were 5,593 August sales across all property types within the “905” TRREB zones. Down -24% vs. August 2020, but up +6% vs. the 5-year August average and up +9% vs. the 10-year August average.

- Sales likely could have surged higher, however, the lack of new and existing listings was the limiting factor.

- The sales-to-new listings ratio (“SNLR”) continued to tighten rising from 82% in July to 87% in August which was a new record for the month.

“905” TRREB Zones – August vs. July – 10 yr History of Sales & New Listings

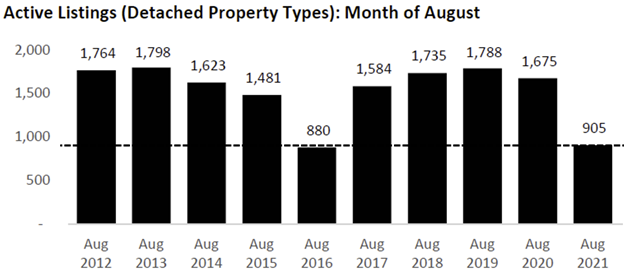

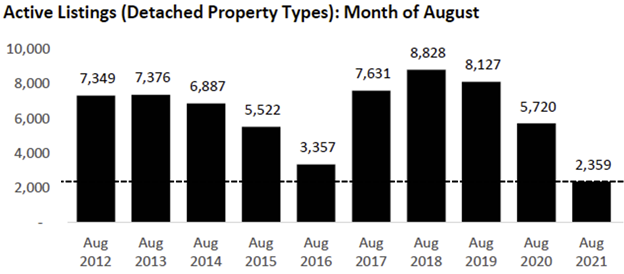

Detached Inventory At or Near Historically Low Levels!

—

“416” Detached Inventory

- At the end of August 2021, there were 905 detached properties available for sale within the “416” TRREB Zones. This was the second lowest for an August (lowest was 880 in August 2016).

—

“905” Detached Inventory

- At the end of August 2021, there were 2,359 detached properties available for sale within the “905” TRREB Zones. This was by far the lowest number of active listings for an August over the past 10 years.

- In this month’s accompanying video (in the above section), we take a virtual road trip across TRREB to explore the low inventory levels across various regions.

This dynamic of record low inventory was not exclusive to detached properties. In fact, the 905 TRREB zones posted record low active listings for an August across all major property types (detached, semi-detached, townhomes, and condos). Within the 416, detached, semi-detached, and townhomes posted the second lowest active listings on record (August 2016 was lowest), while condo active listings remained relatively in line with their 5-year July average — although this may be short lived as listings are dropping quickly.

Mortgage Updates

In this month’s mortgage update video, we explore some of the mortgage and housing related items outlined across the political parties’ platforms. A sample of these items include:

- A possible increase in the $999,999 purchase price cap for insured buyers (i.e., those wanting to buy with less than 20% down payment)

- A possible decrease in CMHC mortgage insurance premiums

- The introduction of a new Tax Free First Time Home Savings Account (similar to an RRSP for tax purposes, but the savings are meant to be used for a down payment of up to $40,000)

- Introduction of a “Flipper Tax” for those that buy and sell a home within 12 months

- 2-year ban on non-resident purchasing of residential property

- As well as other possible changes such as: a ban on blind bidding, right to home inspection, and lenders providing up to a 6-month mortgage deferral for life events.

- For complete details, please go directly to the political party platform websites for a full description and additional context.

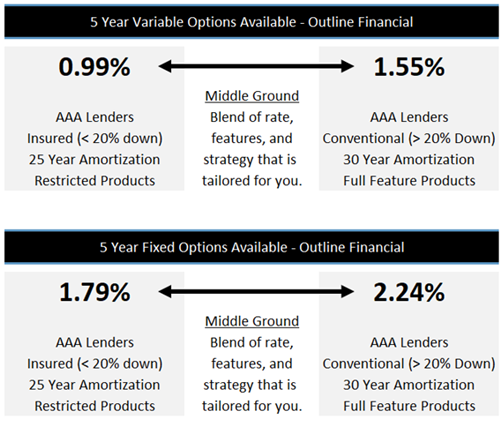

Variable Rate Forecast – as variable rates are linked to a Lenders’/Banks’ prime lending rate, any interest rate movement by the Bank of Canada typically results in an immediate change to variable rates. Based on the most recent outlook, the Bank of Canada has signaled the earliest it would increase its rate would be “the second half of 2022”.

Fixed Rate Forecast – 5-year fixed rates typically follow the Government of Canada 5-year Bond Yields which is the market’s view/prediction of where interest rates will be in the future. After an initial spike in February 2021, bond yields have settled into a range between 0.75 to 1.00. Fixed-rate mortgages have moved in lockstep and also look to have settled in at their current levels outlined in the above rate chart. Based on the current outlook, we do not anticipate any significant changes (up or down) in the near term.